The Families First Coronavirus Response Act created new workplace obligations for employers and expanded supports for individuals affected by the COVID-19 pandemic. Eight days later, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) authorized more than $2 trillion in spending to inject cash into the economy, businesses, and nonprofits. There is a great deal to unpack:

Mandated paid sick and family leave and refundable payroll tax credits

Generous loan funds for small (< 500 employees) and mid-size (between 500 and 10,000 employees) nonprofit employers; which program is best for your organization?

Above-the-line or universal charitable deduction available for 2020

Employee retention refundable tax credit

Expanded unemployment and enhanced funding for social support programs

This webinar will share the latest analysis and information available at the time of the webinar, including translating new guidance and regulations from multiple federal agencies into nonprofit-friendly language, and answering the questions frontline nonprofits need resolved so they can keep their doors open and missions moving forward.

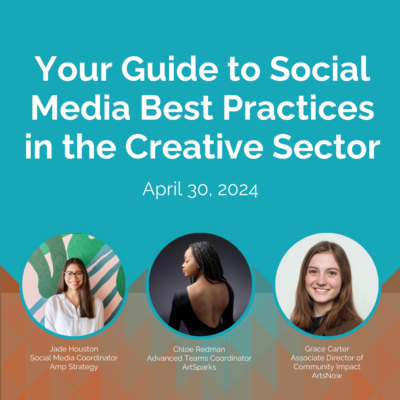

April 30, 2024 | 12:00-1:00 p.m. | Online

In this virtual workshop, Grace Carter, Jade Houston, and Chloe Redman will equip you with all the tools you need to appropriately credit artists’ work on social media.

Who should attend?

Marketing, communication, and social media leadership interested in simplifying best practices for citing and engaging artists and arts nonprofit work online.